Managing your finances as a person with bipolar disorder can be incredibly challenging. In this guide, I’ll review how to manage your money effectively. I share my experiences with medical bills, manic spending, and the resources that helped me regain financial stability after a mental health crisis.

Happy National Minority Mental Health Awareness Month and Welcome Back to Kaipolar Diaries!

Intro: 🎵Get Up 10 – Cardi B🎵

Money and Mental Health

Before we get into the conversation of managing your finances as a person with bipolar disorder, I would like to make something clear. Financial literacy alone cannot lift you out of poverty or a sticky financial situation. Money or some form of capital is necessary to make positive financial gains.

One workshop or online course cannot magically lift the societal barriers that are standing between you and your financial goals. Capitalist society and hustle culture have duped us into believing that every aspect of our lives should be dedicated to productivity and profitability. To that, I say – “Wrong answer forehead!”

This warped point of view leaves us with very little time for true rest. It can also be detrimental to one’s psyche and mental health. All of your time and energy is solely focused on making money and not much else.

Additionally, the cost of living continues to rise while wages virtually remain the same across the board. All of these factors put even more pressure on us to stick to a tighter budget or find additional sources of income to compensate for rising costs.

My Financial Upbringing

Influences

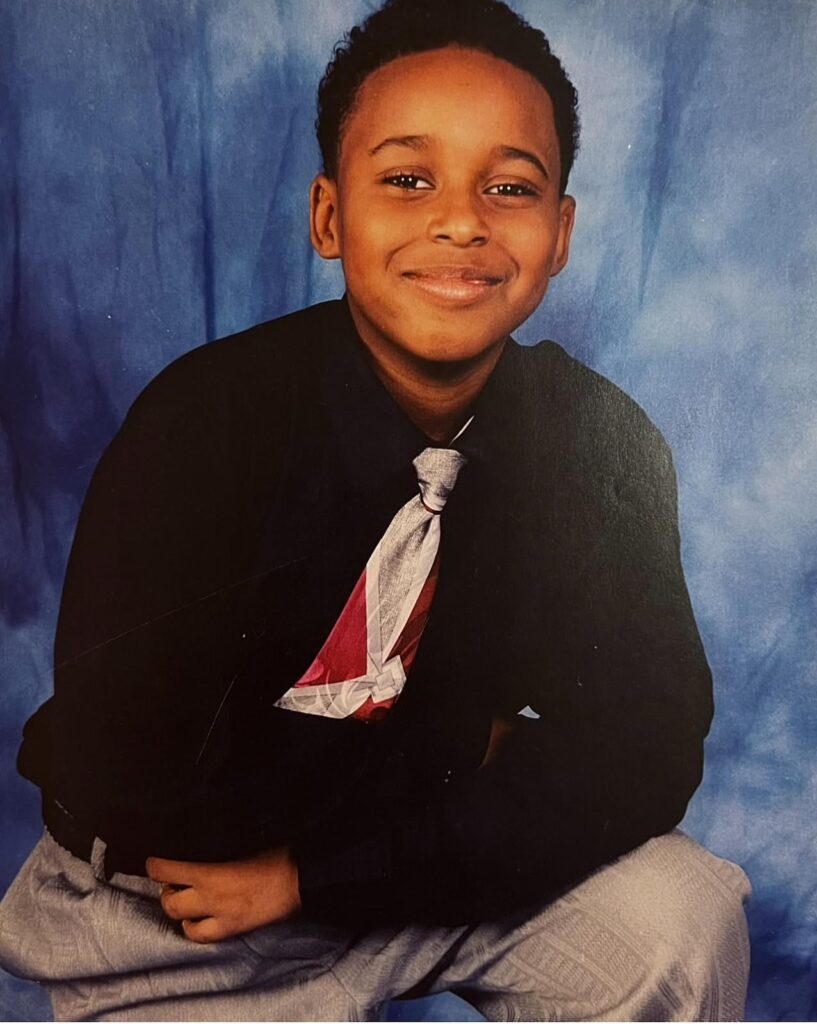

Navigating the economy and financial problems with a mental illness, especially Bipolar Disorder Type I, presents unique challenges. For me, these challenges are amplified by my early relationship with money, which was shaped in childhood and complicated by my diagnosis.

From a young age, I was taught the importance of a strong work ethic. My parents had stable careers—my mom worked for the United States Postal Service, and my dad held various IT positions at companies like Unilever and Hewlett Packard. They also had side hustles. My mom sold Avon and did telemarketing, while my dad repaired computers and helped with tech tasks.

Celebrities like Tyra Banks and Kimora Lee Simmons, who managed to run empires while enjoying luxurious lives, also influenced me. Their humble beginnings resonated with me and made me believe that such success was attainable.

Early Work Experience

I began working at a young age. At nine, I was scouted by a modeling agent. I took acting classes and pursued a child acting career throughout elementary and middle school. This early exposure taught me the value of money, the importance of knowing my worth, and the necessity of budgeting.

Financial awareness was instilled in me early on. My mom encouraged me to invest in a 401(k) as soon as I secured a full-time job. And my dad ensured we understood financial concepts by exposing us to Suzie Orman’s advice on everything from Roth IRAs to Living Revocable Trusts.

So Ambitious

I was academically ambitious, which translated into my adult career. My goal was always to secure a great job with a substantial income and benefits. I aimed for financial freedom and the ability to retire my parents comfortably.

This drive propelled me through college, where I juggled multiple jobs and internships while pursuing a career. By my senior year of college, I was earning about $40,000 annually from three jobs while maintaining a full-time course load. Upon graduation, I transitioned to a corporate career. I also became a freelance motivational speaker in addition to my job in the tech industry.

Although I couldn’t achieve my goal of retiring my parents due to their untimely deaths, I continued to strive for success and financial freedom until 2021. This relentless pursuit led to my first mental breakdown and manic episode at 27.

Fortunately, my mother’s estate planning provided a financial safety net during this challenging period. This emphasized the importance of having one’s affairs in order. Now, as a 30-year-old man with Bipolar Disorder Type I, my definition of success and relationship with money have changed.

My primary goal is to maintain a great income that supports my lifestyle while minimizing stress to avoid triggering manic episodes. My day job suffices, and I focus on passive income streams that don’t interfere with my career or daily tranquility.

What is the financial burden of bipolar disorder?

Budgeting and spending are crucial for me because a hallmark of mania is impulsive behavior. Impulsivity during manic episodes often results in impulsive shopping and spending, which can be highly damaging if unchecked.

Manic Spending

Having Bipolar Disorder Type I makes me more prone to manic episodes, during which impulsive decisions like overspending are common. Impulsive spending can look like:

- Using personal cash

- Maxing out credit cards

- Taking out loans to fund grandiose ideas conceived during mania

- Purchasing high-end items

- Booking expensive vacations

- Buying cars without realistically assessing finances

- Engaging in gambling

- Excessive dining out

- Shopping sprees

Medical Bills

A significant financial burden can also come from hospital bills incurred after a manic episode that requires hospitalization. The American healthcare system is notoriously expensive. Accumulating medical debt on top of other expenses from a manic episode can worsen existing financial troubles and lead to depression.

I have fallen victim to this behavior over the years, sometimes incurring debts upwards of $30,000 between personal and medical expenses. Fortunately, with the help of my financial trainer from the Financial Gym, I have managed to pay down this debt and better manage my finances. If you would like to work with an FG trainer to improve your financial situation, book a free consultation. Mention my name (Kaishon Holloway) during your first session, and they’ll take care of the rest!

I am grateful to have recovered from severe financial situations caused by mania. Below are some lessons I’ve learned to minimize the risk of financial ruin as someone with bipolar disorder.

Tips to Manage Impulsive Spending

- Set a Budget: Creating a strict budget helps track expenses. Allocate funds for essentials and limit discretionary spending.

- Use Cash: Limiting access to credit cards can prevent overspending. Using cash for day-to-day expenses makes it easier to stick to your budget.

- Delay Major Purchases: Implementing a waiting period for significant purchases allows time to reconsider and assess whether the expense is necessary.

- Accountability Partner: Having a trusted friend or family member monitor your spending can help you stay accountable.

- Professional Help: Financial advisors or therapists can provide strategies tailored to your situation.

When Your Mental Health is Impacting Your Work Performance

Most of us need employment to survive but managing finances with bipolar disorder can impact our ability to work. If your job is affecting your mental health, there are options available to help alleviate the pressure and anxiety you may be experiencing.

You can ask for accommodations to lighten your mental load and workload, making it easier to navigate challenging moments at work. This is particularly important for someone with bipolar disorder.

Personally, I have taken a leave of absence a couple of times and have greatly benefited from it. Taking leave gave me the time to focus on my health, delve deeper into therapy, and readjust my medications. Here are some common accommodations you can request at work if your mental health is being impacted:

Work Accomodations

- Flexible Scheduling:

- Adjusting work hours to accommodate your mental health needs can significantly reduce stress and improve work-life balance. This might include flexible start and end times, compressed workweeks, or telecommuting options.

- Leave of Absence:

- Taking time off for therapy, medical appointments, or recovery from a mental health episode is crucial. This could include short-term leave or extended leave as necessary.

- Workload Adjustments:

- Modifying tasks, reducing workload, or redistributing responsibilities can help you manage stress and maintain productivity. This ensures tasks align with your current capacity and strengths.

- Environmental Changes:

- Creating a comfortable and supportive work environment can make a significant difference. This might involve providing a quiet workspace, noise-canceling headphones, adjustable lighting, or allowing remote work to minimize environmental stressors.

- Access to Mental Health Resources:

- Having information about Employee Assistance Programs (EAPs), facilitating access to counseling services, and offering workshops or training on stress management and mental health awareness can support you in managing your mental health effectively.

These accommodations are commonly implemented because they address a wide range of mental health needs and can be tailored to individual circumstances, promoting a healthier and more productive workplace.

Additionally, NAMI (National Alliance on Mental Illness) has a super helpful guide for how to request accommodations. Their detailed list includes asking your employer’s HR personnel about the process, then deciding on the specific accommodations you need and put your request in writing. They also suggest obtaining documentation from your treatment provider and keeping detailed records of all communications with your employer.

The Balancing Act

Balancing the impulsivity of bipolar disorder with the need for financial stability is challenging but achievable. Remember, it’s important to seek professional advice tailored to your unique needs. Therapists, financial advisors, and support groups can provide valuable resources and support. Managing finances with bipolar disorder is a journey, and it’s okay to seek help along the way.

You don’t have to have 18 side hustles and 4 LLCs to live a happy, financially secure life. You can keep things simple and still have a fulfilling path ahead. With the right strategies and support, you can achieve financial stability and peace of mind – I’ve done it and so can you!

Take care of yourself and be kind to others.

Xo,

Kai$hon

Outro: 🎵I Am – Baby Tate ft. Flo Milli🎵